how are rsus taxed at ipo

The current market value keeps changingI. Restricted Stock Units RSUs Jan 1.

Rsu Taxes Explained 4 Tax Strategies For 2022

2020 and 2021 saw numerous IPOs.

. In order to make employee compensation more manageable for tech companies at least a portion of it can be paid in the form. Often less than 1. The fair market value of RSUs is taxable as ordinary income on the date that shares are actually transferred to the employee.

Tax rates and tab le. Your company has its IPO. If I receive RSUs from a pre-IPO company on a 4 year vesting schedule when do my RSUs get taxed.

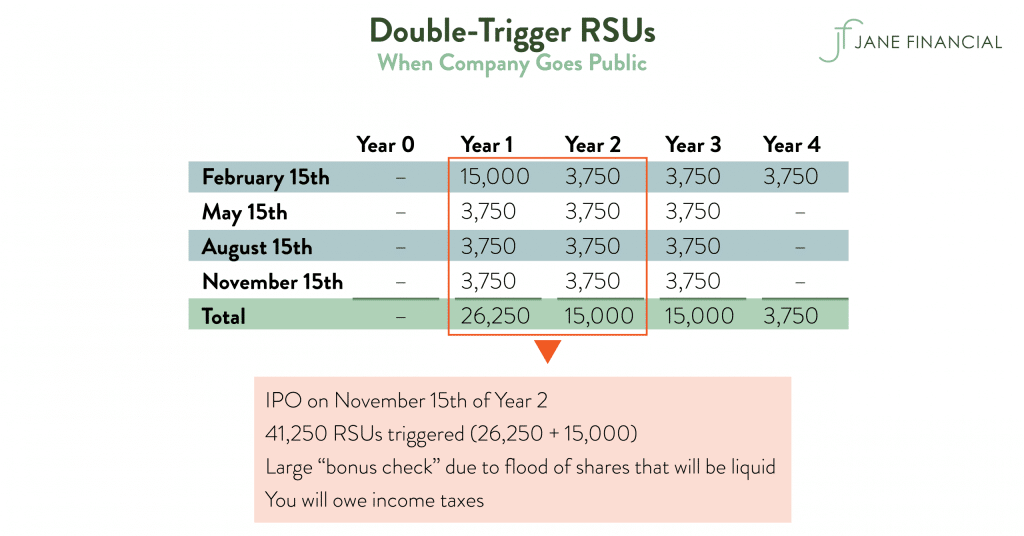

Dec 10 2020 3. IPOs are causing a lot of excitement. New IPO companies may also utilize grants during a liquidity event before the IPO and shares vest.

Once the liquidity event has occurred the shares vest 180 days later. Most early employees will receive pre IPO stock options. Carol Nachbaur April 29 2022.

Your RSUs vest and become taxable 180 days after Event 2. That means every month 22 of your 10 shares in Equity R Us are actually withheld from you for tax purposes. The price could have fallen from the IPO list price.

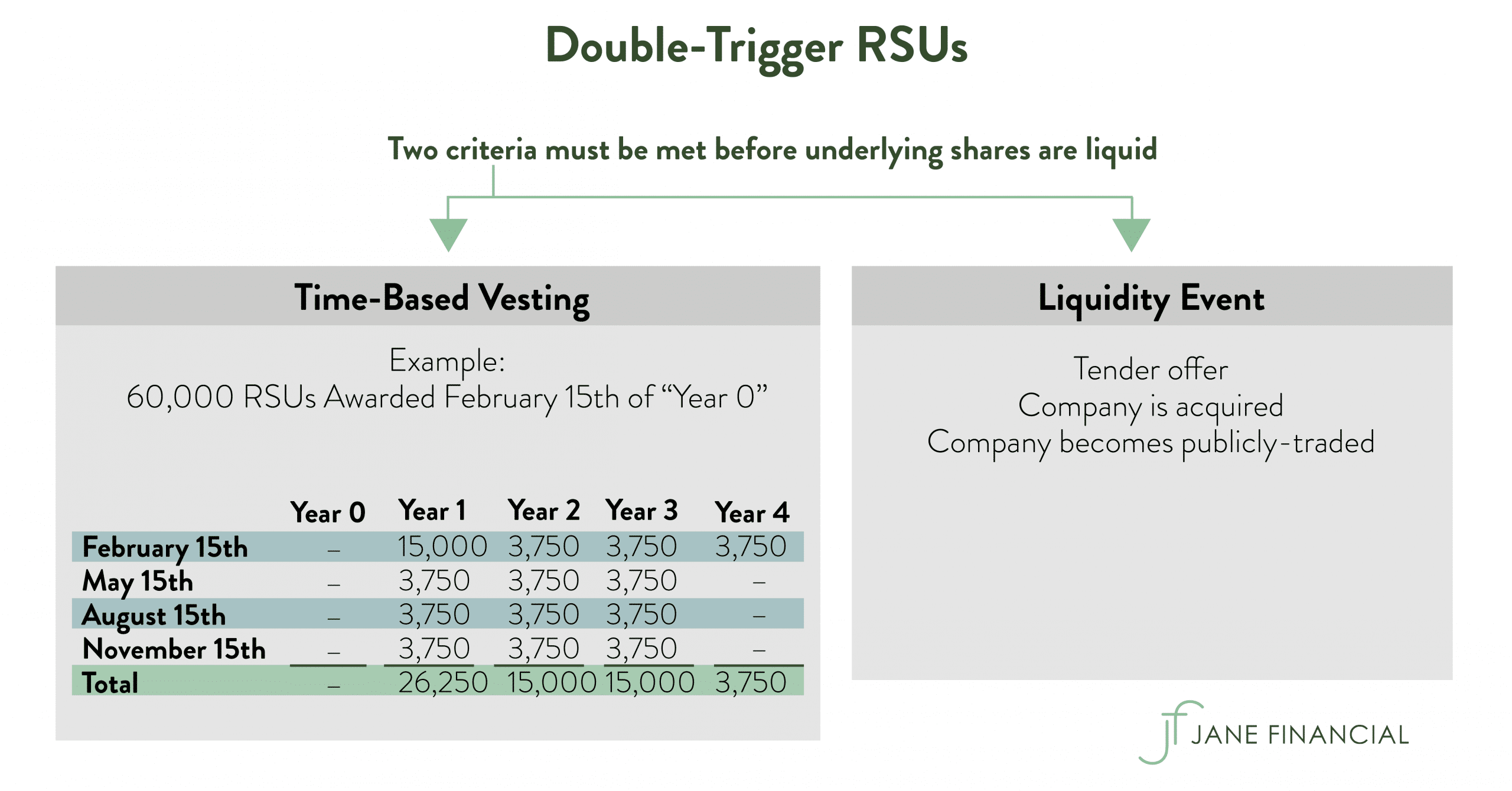

RSUs are taxed as ordinary income as of the date they become fully vested using the FMV of the shares on the date of vesting. And yes you are able to report capital losses on your taxes but its not pretty. RSUs or Restricted Stock Units trigger ordinary income tax when they vest and many RSUs have a vesting schedule thats reliant on an IPO.

The termination of an employee always halts the vesting process unless otherwise previously agreed upon. Regardless of market fluctuations an RSU always has value. Outside investors whove been wanting to purchase company equity can finally get a piece of the pie and company insiders who own a lot of company stock finally have an opportunity to sell some shares.

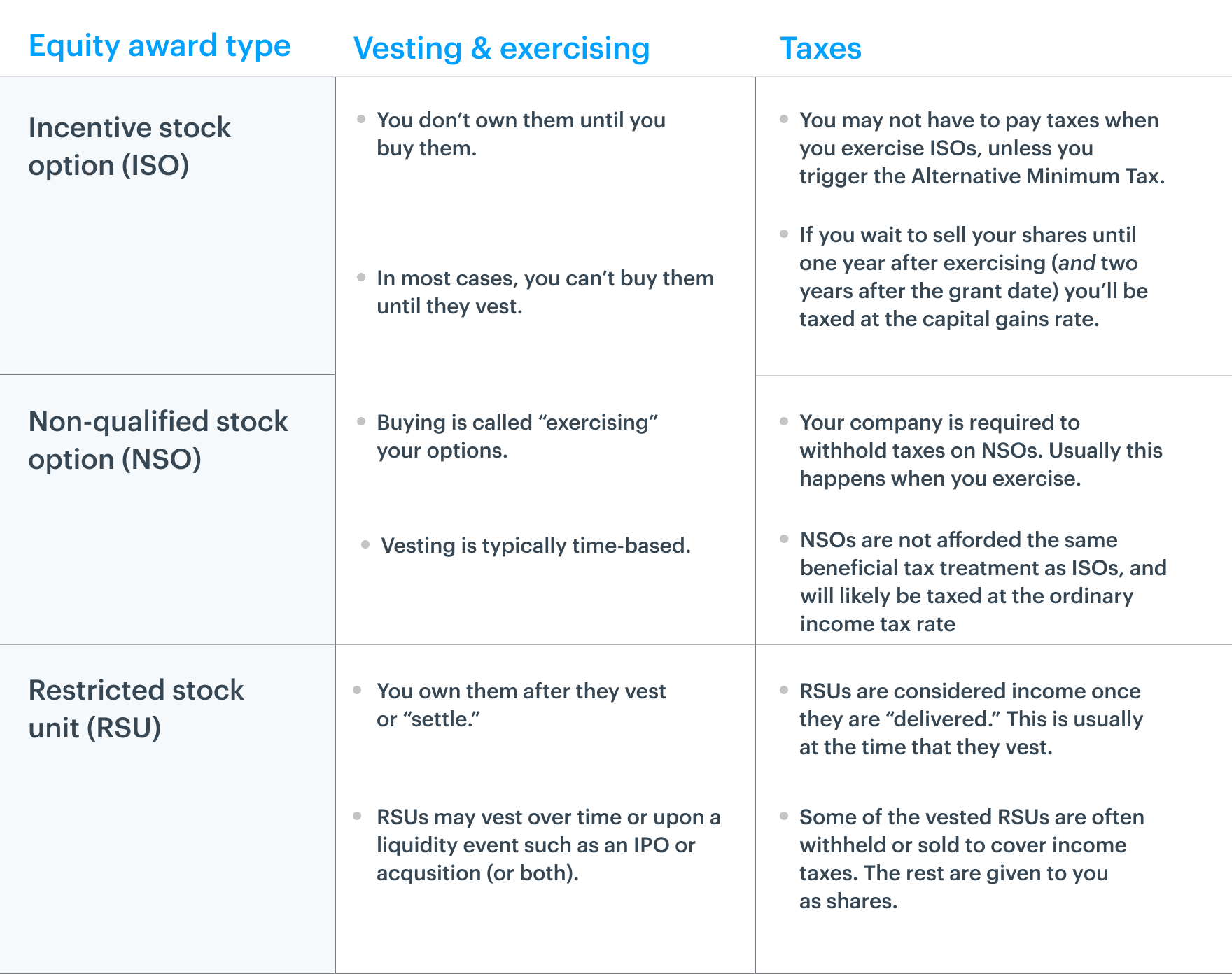

Typically employees need to pay attention to three specific ways that an IPO can impact their taxes. Your company has its IPO. The three most common forms of equity compensation will include incentive stock options ISOs non-qualified stock options NQSOs and restricted stock units RSUs.

Currently employers must withhold at least 22 of your RSUs and more if you have excess of 1 million in supplemental income. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax withholdings showing you the additional taxes due that you may need to prepare for. My grant price per RSU was 20.

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. The calculator primarily focuses on Restricted Stock Units RSUs. If RSUs vest while youre at a private company they usually wont be taxed until your company goes.

I vested 2 years worth of RSUs before the company IPOed at 50. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax withholdings showing you the additional taxes due that you may need to. RSU Taxes - A tech employees guide to tax on restricted stock units.

Meanwhile a fateful decision by Uber that could have delighted these people is only aggravating. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. No lockupinteresting I thought it is a must per SEC.

How Are Restricted Stock Units RSUs Taxed. This means that your RSUs will vest or be considered income after an IPO. An IPO triggers taxes for RSUs even if you arent ready to sell the shares.

Here is an article on employee stock options. RSUs or Restricted Stock Units trigger ordinary income tax when they vest and many RSUs have a vesting schedule thats reliant on an IPO. With RSUs if 300 shares vest at 10 a share selling yields 3000.

RSUs will become more prevalent closer to an exit. Prior to an IPO the company may have a. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry.

Hi Blind making some numbers up to stay anonymousI was given 100k worth RSUs vestable quarterly over 4 years. An IPO triggers taxes for RSUs even if you arent ready to sell the shares. Keep in mind that RSUs for.

So combined with the quote you gave unless the terms of the RSU specify otherwise. But Im pretty sure I havent been taxes on RSUs Ive received from a pre-IPO company so I suspect its not always when the shares. Watch out for RSUs.

How RSUs Get Taxed Due to a more simple taxation method on RSU stocks they are a bit more straightforward regarding employee stock plans. Unlike stock options which can go underwater and lose all practical value. RSUs can also be subject to capital.

Dec 10 2020 0. Palantir DPOed and had no lockup on RSUs so everyone could sell to cover taxes immediately on listing day. You can get a sense of how close your company is to an.

Dec 10 2020 2 1. For private companies it works the same way as public companies. You are granted some RSUs.

The company will take 22 of your shares sell them at the Fair Market Value of the stock on the. As tax season begins some of Ubers earliest employees are realizing they had little idea how their stock grants worked and are now grappling with the fallout on their tax bills after last Mays disappointing IPO. With RSUs you are taxed when the shares are delivered which is almost always at vesting.

That is the required withholdings can be met with a cash payment from the employee or the company can withhold an equivalent value of shares. Answer 1 of 3.

Rsu Taxes Explained 4 Tax Strategies For 2022

Stock Options Rsus From Startup To Ipo Or Acquisition 5 Key Points From Top Financial Advisors

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

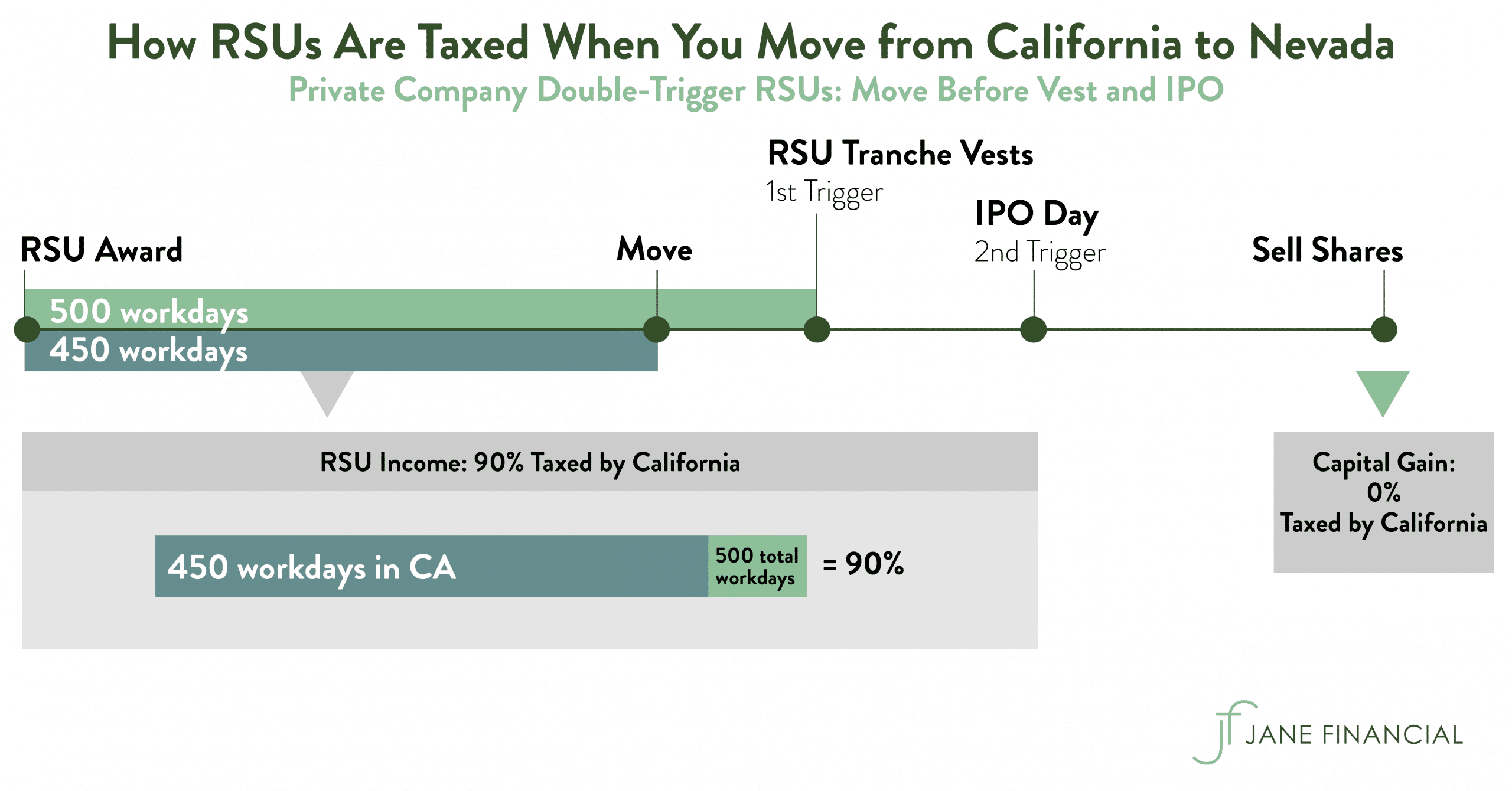

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Uber Lyft Pinterest And Zoom Sec Filings Reveal Trends In Private Company Stock Grant Design

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial

How Equity Holding Employees Can Prepare For An Ipo Carta

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Uber Lyft Pinterest And Zoom Sec Filings Reveal Trends In Private Company Stock Grant Design

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial